Valerie's Real Estate Thoughts and Advice

Tue Sep 15 16:19:00 UTC 2020

New You Tube Video for COVID 19

Tue Jan 29 21:04:00 UTC 2019

VA Financing for Your Home

Your VA Home Loan Explained

One of the most significant benefits of military service is the VA home loan which can help you purchase a home or refinance an existing loan. This gives you the opportunity to get a mortgage with a competitive interest rate as well as a lower cost at closing without prepayment penalty. VA Home Financing is one of the few options available today for no money down mortgage financing. In addition, it gives increased buying power as the allowable loan-to-value and debt-to-income ratios are more generous than for conventional financing. These benefits give you the potential to buy a more expensive home than you might otherwise have been able to afford.The VA does not actually loan you the money. They guarantee a loan made to you by a lender i.e. banks, savings & loans or mortgage companies. If a home loan is approved by your lender, the VA will guarantee a portion of that loan to the lender.

There is no maximum to the amount of the loan, but the VA does have a limit to how much it will guarantee. This limit can vary around the country and is based on which State & County the property is in. To find out what your area limits are click here:

www.militarybenefits.info/va-loan-limits-by-county

Benefits of VA Home Loans include:

1. No down payment as long as the sale price does not exceed the appraised value.

2. Loan-to-value ratio of 100%

3. Back-end debt-to-income ratio of 41% under certain circumstances

4. No private mortgage insurance

5. Limits on Closing costs, which may be paid by the seller

6. No penalty for early payoff

7. Loan is assumable by another qualified veteran borrower

8. Ability to apply for a new loan two years or sooner after a bankruptcy

9. The VA has no loan limits, only a maximum that can be borrowed with a zero down payment.

Are You Eligible for a VA Loan?

There are several categories for eligibility, but here are some of the major ones:1. Veterans and service persons who have served more than 181 active-duty days during peacetime, unless discharged or separated from a previous qualifying period of active-duty service.

2. Veterans who served during WWII, Korea or Vietnam, if they served for 90 days and were honorably discharged.

3. If you have served for any period since August 2 1990, you can also qualify if you have served 24 months of continuous active duty, or the full period that you were called to active-duty (at least 90 days).

4. Have completed a total of 6 years in the National Guard or Selected Reserve.

5. Any spouse (who has not remarried) of a veteran who died while in service or from a service related disability, or a spouse of a serviceman MIA or a POW.

For full details of eligibility requirements click here:

https://www.benefits.va.gov/homeloans/purchaseco_eligibility.asp

What if you have lost or destroyed discharge papers? You will need to obtain a Certificate of Military Service. This can be achieved by completing GSA Form SF-180 and can be completed online at:

www.archives.gov/veterans/evetrecs

You will need this in order to apply for your Certificate of Eligibility unless you have your discharge papers.

How to Apply for a VA Loan

There are several basic steps in the VA home loan application process. The first thing you need to do is get your Certificate of Eligibility. This proves to the lender that you are eligible for a VA loan. Information on how to obtain this Certificate can be found at:https:// www.benefits.va.gov/HOMELOANS/purchaseco_certificate.asp

If you are not sure whether or not you qualify for a COE you can visit the VA's eBenefits website:

www.ebenefits.va.gov/ebenefits-portal

You can also contact the VA Eligibility Center by mail at P.O. Box 100034, Attn: COE (262), Decateur, GA 30331.

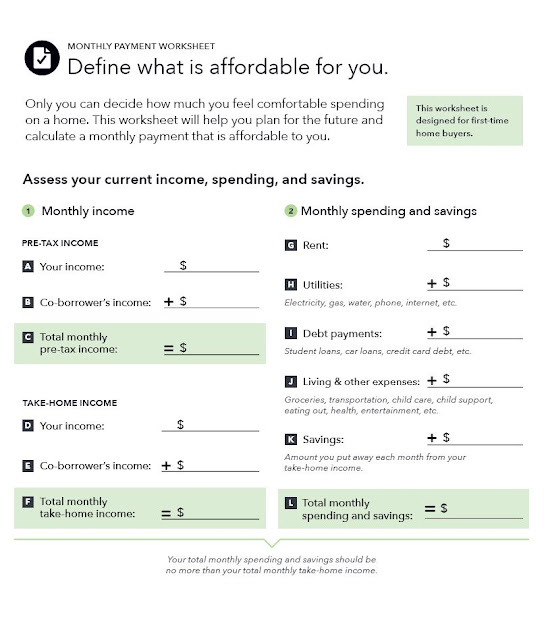

Once you have your COE, now you can approach lenders to find out much you can borrow and get your letter of Pre-Approval. This letter can often help in the offer process as it shows the seller that you are able to get a loan to purchase the house. Here is a sample form that you can use to work out ahead of time what you can afford. If you would like a copy of this worksheet please give me a call and I will be happy to send it to you.

There are many different types of mortgage available and you should definitely shop around for the best rates and terms. Here is a link to the Consumer Financial Protection Bureau website that will give you lots of info on mortgages and a mortgage calculator.

https://www.consumerfinance.gov/owning-a-home/loan-options/#loan-term-calculator

So, now you have chosen your lender, you have your letter of Pre-Approval in your hand - IT"S TIME TO GO HOUSE SHOPPING! Please make sure you find yourself a good Real Estate Broker with excellent knowledge of the VA loan process.

You've found your dream home! Now what? With the assistance of your Real Estate Broker you will make a formal offer to purchase the house and once the offer has been accepted and contracts signed you will start the process of submitting your mortgage application. You will be required to submit a significant amount of paperwork as evidence to support your ability to qualify for the mortgage.

VA Document Checklist

* Certificate of Eligibility; Obtain VA Form 26 1880.* Complete Bank Statements from the most recent three months for all accounts

* Most Statements from retirement, 401k, mutual funds, money market, stocks, bonds & inheritances

* If applicable copies of spouses financial accounts and phone numbers

* Latest credit card statements, including minimum payments and account numbers

* Name, address and phone number of your landlord, or 12 months of cancelled rent checks

* If you have no credit card bills copies of your most recent utility bills

* If applicable, copy of complete bankruptcy and discharge papers

* If you co-signed for a mortgage, car, credit card etc., copies of 12 months cancelled checks

* If applicable copies of spouses credit card accounts

* Copy of drivers license

* Copy of Social Security Card

* If applicable, copies of complete divorce, palimony or alimony paperwork

* If applicable, copy of Green Card or Work Permit

If you are refinancing or own rental property you may also need to provide the following:

* Copy of Note and Deed from current loan

* Copy of Property Tax Bill

* Copy of Homeowners Insurance Policy

* Copy of Payment Coupon for current Mortgage

* If Property is Multi Unit, copies of rental agreements.

So, I've already mentioned that you can get a 100% loan from the VA, BUT, that does not mean that you will have no costs. The VA charges a Funding Fee which varies depending on your personal circumstances and ranges from 1.25% up to 3.3%. Your mortgage lender may also charge an Origination Fee of up to 1%. The Origination Fee must include the following charges:

* Settlement fee

* Any additional appraisals and inspections

* Escrow, closing fee

* Document preparation

* Underwriting fee

* Processing Fee

* Application Fee

* Interest rate lock-in

* Attorney fees (for work other than title)

* Assignment fee

* Photocopying

* E-mail or fax

* Photographs

* Postage

* Amortization schedule

* Notary fee

* Commitment fee

* Marketing fee

* Trustee fee

* Truth in lending fee

* Tax service fee

There are however some expenses that are NEVER paid by the VA borrower:

* Termite/pest inspection

* Attorney fees as a benefit to the lender

* Mortgage broker fee

* Prepayment penalties

* HUD/FHA inspection fees to builders

* Real Estate professional's commission

Misconceptions About VA Financing

Some common misconceptions about VA eligibility and entitlement include:* Eligibility for VA financing means guaranteed qualification for a loan, even with bad credit - Not true, every lender has different criteria for credit scores. Check with your lender to find out what their minimum score requirements are.

* A bad credit report doesn't matter because the VA guarantees 100% of the loan even if the borrower defaults on the payments - The VA does not guarantee 100% of the loan and your credit report/score is a vital component of qualification for a mortgage loan

* A preapproval or prequalification isn't needed when the buyer plans to use VA financing - This letter from your lender can be an important negotiating tool during the Offer to Purchase Process.

* VA financing can only be used once - Veterans who had a VA loan in the past may still have remaining entitlement to use for another VA loan. Selling the property and paying off the loan fully restores the entitlement for future use.

WOW, that's a lot of information! The process of finding and buying a house can seem completely daunting, especially to the first time buyer. All the more reason to get yourself experienced help from a licensed Real Estate Broker who will help you through from start to finish. They will offer advice, knowledge and support and will be able to connect you with other professionals in the area such as mortgage lenders, closing attorneys and home inspectors.

I hope that you have found the information in this blog useful, but if you have any questions or need more information please do not hesitate to give me a call or email me. I will be happy to sit down with you and go through the process in detail from beginning to end.

Here at Century 21 Sterling Real Estate we are looking to actively support our military. We offer financial assistance to transitioning military who would like to pursue a career in real estate. We also offer that assistance to trailing spouses where appropriate. Century 21 also offers incentives for veterans. If you would like to receive a copy of the brochure "Heroes Wanted" please call or email me. Come join us and discover innovation to feed your relentless drive.

Valerie McKean, GRI, ABR, MRP, SRES

Owner/Broker & Military Relocation Professional

Century 21 Sterling Combs

Sat Feb 24 22:41:00 UTC 2018

Spring has Sprung in Pinehurst and my thoughts are of Gardening

Century 21 Sterling Real Estate

February 24th 2018

Sun Oct 29 19:45:00 UTC 2017

What is a Reverse Mortgage and is it Right for You?

Century 21 Sterling Real Estate

Sun Oct 08 18:03:00 UTC 2017

A Nice Home or A Nice Neighborhood: Which Matters More?

Century 21 Sterling Real Estate

Sat Sep 30 20:08:00 UTC 2017

Realtor® Vs For Sale By Owner (FSBO)

5 Important Reasons Why you should use a Realtor® to sell your house instead of Trying to Sell it Yourself

No. 1 Money

According to the National Association of Realtors®, sellers using a Realtor® to sell their home will realize more money in the end.However, a FSBO does not have to pay a percentage of the sale price to a listing broker.

No. 2 Marketing

A Realtor® has access to the Multiple Listing Service where thousands of other Realtors® can see your property and show their clients. Buyers also have access through realtor.com. Many of the MLS providers list their properties on Zillow and Trulia.Without access to the MLS, FSBO's will have to pay out of pocket for all advertising to market their homes.

No. 3 Time

A good Realtor® will dedicate a lot of their time and energy marketing and promoting your house to sell.Owners generally struggle to find enough time to effectively market and show their home to potential buyers.

No. 4 Negotiation

Realtors® are experienced negotiators in the sale and purchase of real estate.Inexperienced sellers must negotiate and avoid all the legal pitfalls on their own.

No. 5 Legal Issues

An experienced Realtor® will work within the laws of the State, co-ordinate all aspects of the sale with attorneys and other Realtors® involved in the contract. They will ensure that all important dates and deadlines are adhered to, ensuring a smooth closing.Unless a FSBO has legal knowledge of the process and law of real estate, there is always a potential risk for an error to be made, resulting in the Seller being sued by the Buyer.

Century 21 Sterling Real Estate

Sat Sep 30 19:26:00 UTC 2017

Is an Income Producing Investment Property Right for You?

Century 21 Sterling Real Estate

Sat Sep 23 20:23:00 UTC 2017

What is a Home Warranty Plan?

Follow the link below to see the latest research on home warranties from the Consumer Advocate Organization.

https://www.consumersadvocate.org/home-warranties

Century 21 Sterling Real Estate

Sun Sep 10 17:53:00 UTC 2017

Buying A Home with Bad Credit

The following websites have additional information and offer help and advice:

www.annualcreditreport.com - Get your free annual credit report from each of the 3 agencies.

www.creditkarma.com - Get your free credit score.

www.OptoutPrescreen.com - Is the official website for the Consumer Reporting Industry. Opt in or out of credit companies sending you offers.

www.mint.com - Get help organizing and keeping track of your finances.

Century 21 Sterling Real Estate

Sat Sep 02 18:01:00 UTC 2017

Getting Your Home Ready to Sell

Valerie McKean,

Owner/Broker

Century 21 Sterling Real Estate

30 Chinquapin Rd

Pinehurst, NC 28374

Tel: 910-430-9494

valerie@pinehursthomes.com

www.pinehursthomes.com

Sat Sep 02 17:02:00 UTC 2017

Avoid The Most Common Mistakes When Selling Your Home

Valerie McKean,

Owner/Broker

Century 21 Sterling Real Estate

30 Chinquapin Rd

Pinehurst, NC 28374

Tel: 910-430-9494

valerie@pinehursthomes.com

www.pinehursthomes.com

Sat Sep 02 15:47:00 UTC 2017

What a REALTORⓇ Can Do For You As A Buyer

When we think of selling a home, the services a REALTOR® can provide

usually seem worth the cost of their commission, but what about as a

buyer? What can a REALTOR® do for you as a home buyer? Here are five

great reasons you should hire a REALTOR® when you are in the market for a

new home!

1. REALTORS® Can Help You Determine Your Budget.

With a few simple

pieces of information, a REALTOR® can help you pre-determine what kind

of budget you may be looking at for your new home, and can match you

with potential lenders that are right for you.

2. REALTORS® Have Access To Resources You Don't.

While a lot of real

estate listings are available online, there are still resources and

listings that are only available through a REALTOR®. If you are looking

for something very specific, having their insider knowledge may be

crucial to finding that perfect home.

3. REALTORS® Can Read Between The Lines Of Listings.

There are a lot of

catchy phrases that often appear in home listings, and your agent can

tell you what they really mean.

4. REALTORS® Increase Your Negotiating Power.

A REALTOR® cannot only

increase your ability to negotiate things like price, they can also give

you advice and help guide you though the contracts and required

paperwork. A good REALTOR® should assist you with all aspects of

purchasing a home, whether it is helping to co-ordinate inspections and

surveys or working closely with you and your mortgage provider to ensure

everything is ready by your closing date.

5. A REALTOR® Can Help You Navigate Through The Closing Process.

The

closing process can be complicated and a REALTOR® can make sure all the

details are addressed.

Purchasing a home is a huge financial investment, and having a

professional REALTOR® looking after your interests through the process

is important.

Valerie McKean

REALTOR®

Sandhills Luxury Homes

valerie@pinehursthomes.net

www.pinehursthomes.net

Tel: 910-420-0505

August 20th 2017

Sat Sep 02 15:28:00 UTC 2017

The Benefits of Home Ownership

The decision to purchase a home is exciting and a major investment

for your future. Because there is only so much of it to go around, real

estate is the top choice for many investors and the desire for most

families. This article is designed to highlight some of the many

benefits of home ownership and how buying a home can often turn the

American Dream into a reality.

One of the most profitable markets in real estate is rentals, which

means that many families are paying to live in a home that isn't their

own. In some cases, renting a home is necessary. For all others, the

money that would be spent on rent could instead be used to pay a

mortgage. In fact, monthly rent payments often exceed that of a typical

mortgage payment. One of the greatest benefits of home ownership is

putting money into something that you can call your own and knowing that

the monthly payments are going toward your home's equity.

Speaking of equity, many properties experience a growth in value as

more development moves into the area or the economy strengthens through

an increase in job opportunities. If this happens, home values soar and

owners can bask in the glory of their newfound profit. When you purchase

a new car, it depreciates the moment that you drive off of the

lot. When you buy a home, however, it has the potential to appreciate

year after year. There are few things in life that can offer you a

return above and beyond your original purchase price, but a home can.

When you own a home, you will enjoy the freedom of decorating and

making any changes that you choose without needing the permission of a

landlord or property owner. In addition, you may even be able to use

your home's equity to finance some needed improvements and/or

repairs. In some cases, these changes may even increase the value of

your home. An upgraded kitchen or bathroom, hardwood flooring or an

additional room are examples of changes that could result in added

value.

Another advantage of home ownership is the tax benefits that are

available. The interest paid on a home mortgage as well as most property

taxes paid are tax deductible. For additional information on deducting

mortgage interest and property tax, consult the IRS or a tax

professional.

In addition to providing yourself and your family with a feeling of

stability and permanence, home ownership can also help strengthen your

credit profile through timely mortgage payments and a steady financial

history.

Valerie McKean,

Owner/Broker

Century 21 Sterling Real Estate

30 Chinquapin Rd

Pinehurst, NC 28374

Tel: 910-430-9494

valerie@pinehursthomes.com

www.pinehursthomes.comAugust 13th 2017

Sat Sep 02 15:25:00 UTC 2017

Buying vs Renting a Home

When it comes to a home, you have two options: buy or rent. What is

right for one person may not be right for another, which is why it's

important to know which is the best option for your individual

situation.

Why People Rent

There are a number of reasons why someone may either choose or be

forced to rent, including sporadic or unpredictable income, a high

debt-to-income ratio, a bankruptcy or foreclosure within the last six

months, unpaid collection accounts or judgments, frequent relocating for

employment or the inability to save enough money for a required down

payment on the purchase of a home.

Maintenance Matters

As a homeowner, you will be responsible for any maintenance or repair

issues that arise. This is a big consideration when choosing whether to

rent or buy. When you rent, the property owner is responsible for

repairs and it may not always be obvious that these issues can be very

costly.

How To Know When It's Time To Buy

If you have steady income with a good employment history, can provide

a down payment of at least 5-10 percent of the purchase price and are

current with all debts, it may be time to consider buying a home instead

of renting. In some cases, the cost of rent may even exceed that of a

typical mortgage payment.

When deciding to buy, job stability is a big factor. If your job does

not require frequent relocation and you plan to live in the home for at

least 5-10 years, you may want to consider making the purchase. If you

need to relocate after that, you may have enough equity from the sale to

use as a down payment on another home.

Home Buyer's Checklist

If you can answer yes to the following questions, you may be ready

for home ownership. Your REALTOR® can help you to find the perfect home

based on your individual needs.

Have you been steadily employed for at least one year, but preferably two years?

Do you plan to live in the home long enough to build equity?

Can you provide a down payment and still have enough money left to pay for closing costs, utilities and home furnishings?

Are you current on all debts, including auto loans, credit cards, etc.?

In addition to any current debts that you may have, can you afford a

monthly mortgage payment which will likely include property taxes and

insurance?

Do you have the time to devote to shopping for a home and comparing interest rates from various lenders?

Have you checked your credit reports for inaccuracies and disputed

anything that needs correction with each of the three major credit

reporting agencies?

The decision to buy or rent is a very personal one that can only be

determined after a careful evaluation of your situation. A REALTOR® can

show you the perfect home and a lender can tell you whether or not you

can afford it, but it's up to you to make the choice as to whether or

not you are ready to make the move.

Valerie McKean,

Owner/Broker

Century 21 Sterling Real Estate

30 Chinquapin Rd

Pinehurst, NC 28374

Tel: 910-430-9494

valerie@pinehursthomes.com

www.pinehursthomes.com

August 17, 2017